Our Office Dog’s Instagram Account

Cody Keyt, the KEYTLaw office dog, created an Instagram account. Follow his Instrgram account at arizonalawdog. See Cody’s biography web page.

Cody Keyt, the KEYTLaw office dog, created an Instagram account. Follow his Instrgram account at arizonalawdog. See Cody’s biography web page.

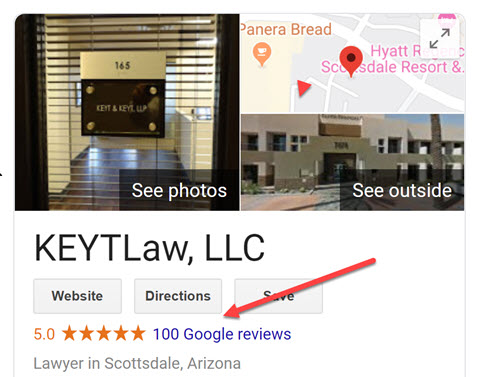

This week a client gave us our 100th five star Google review. We now have 262 five star Google reviews and 398 total five star reviews on Google and Birdeye. Thanks to all who have given us a five star review.

To crack down on terrorists, drug dealers and human traffickers the House Financial Services Committee in June of 2019 passed the Corporate Transparency Act. The bill would require all limited liability companies and corporations that have less than $5 million of revenue or twenty employees to disclose to the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) personal information about the entity’s owners.

Each entity subject to this law must report to FinCEN the social security number, drivers license information, address, birth date and name of all owners of the entity. The penalty for not complying is a $10,000 fine and up to three years in jail.

The Wall St. Journal said “The reality is that the law would hit small businesses with another compliance burden, their confidential information would become less secure, and real criminals are unlikely to be deterred.”

The National Federation of Independent Business (NFIB) said the law is a “threat to more than 5 million small businesses in America.”

On June 28, 2019, the Arizona Corporation Commission’s website stopped displaying documents associated with entities and that problem exists today, July 1, 2019. When you look up a company on the ACC’s website you can click on the icon on the bottom right that says “Document History” and the site will display documents associated with the company. However, when you click on the link to a document you get an error message “No Documents To Display.”

The ACC is aware of the problem. Let’s hope the problem is fixed soon.

On May 13, 2019, the IRS will change its Employer ID number (EIN) application procedure by eliminating the ability of an entity to be the “responsible party” that applies for the EIN. The responsible party that can apply for an EIN must have either a social security number (SSAN) or an international tax identification number (ITIN). An ITIN is a number the IRS issues to non-U.S. residents. Only people can have a SSAN or an ITIN so all applicants must be a person.

On March 28, 2019, and again on April 1, 2019, I filed Articles of Organization on the Arizona Corporation Commission’s website using its online filing system. All the data that I entered was displayed correctly on the ACC’s review screen so I paid the $85 expedited filing fee and saved the invoice. So far so good. I went to my dashboard and accepted the nomination to be the statutory agent of each LLC.

What should have happened next was the ACC’s system should have approved the Articles of Organization and given me links to the actual Articles of Organization and the ACC’s approval letter so I could download and save the documents. I got a link to each each document, but when I opened a document it did not contain any information about the newly formed LLC. Nor could I find the LLC in the ACC’s system when I searched for the LLC by its name.

The Articles of Organization for each of the LLCs looked like this:

When this happened on March 28, 2019, I contacted the ACC and reported the problem. It notified its website vendor of the problem and the vendor fixed it the following day.

When I got the blank Articles of Organization on April 1, 2019, I notified the ACC of the problem, but as of writing this article the ACC has not approved the Articles of Organization and the LLC is pending. We’ve sent several email messages to the ACC without any response. Calling the ACC is a waste of time because we are on hold for 45 – 60 minutes and then get a person who cannot solve the problem.

Bottom line: The ACC’s online LLC formation system is broken. Do not use it because you risk having your data lost in cyber-space and not being able to get any help from the Arizona Corporation Commission.

We will form your new Arizona LLC or PLLC and get its Articles of Organization approved by the Arizona Corporation Commission the same day you hire us (including Saturdays and Sundays) if you:

If you satisfy both of the above requirements before 4 pm Arizona time any day of the week we will form your company and get the ACC approval the same day otherwise we may form the company the next day. We will also email to your company’s contact person a copy of the ACC approved Articles of Organization the same day we get its approval.

Bottom line: With same day service it is possible to open a bank account for your new LLC or PLLC the same day you hire us to form your company.

[bctt tweet=”Arizona LLC attorney Richard Keyt who has formed 6,300+ LLCs now offers same day LLC formation and state approval.” username=”azattorney”]

Arizona Attorney General Mark Brnovich announced today [March 11, 2019] that his office recently filed suit in the U.S. Supreme Court against the State of California seeking to invalidate California’s extraterritorial tax assessments and seizures, which result from an unconstitutional “doing business” tax against businesses and individuals that don’t actually conduct any business in California.

Every year, California assesses an $800 “doing business” taxes against Arizona businesses that conduct no actual business in California. Instead, their only connection to California is a mere passive, non-managing investment in a California limited liability company. California continues to assess these “doing business” taxes even though both its state courts and tax appeals agency have held that the taxes are illegal under California law.

The lawsuit filed by Arizona alleges that these taxes are plainly unconstitutional under the Due Process and Commerce Clauses of the U.S. Constitution. The Supreme Court has held that passive investment in a company located in another state is not sufficient “minimum contacts” to impose taxation under the Due Process Clause (Shaffer v. Heitner, 433 U.S. 186 (1977)). The Supreme Court has also recognized four requirements for states to impose taxes on out-of-state businesses under the Commerce Clause. California’s “doing business” assessments brazenly violate all four.

The amounts collected by these “doing business” assessments are substantial. Arizona estimates that its citizens pay over $10 million in these unconstitutional taxes to the State of California every year.

These taxes also impact Arizona’s tax collections. Since the “doing business” taxes are deductible expenses, Arizona loses an estimated $484,000 in tax revenue each year due to California’s illegal taxation.

These figures are further compounded since the tax applies to all individuals in other states who invest in California businesses.

Extraterritorial Seizures

Making matters worse, if California’s tax assessments are not paid voluntarily, California frequently further tramples on the sovereignty of other states by issuing orders to interstate banks, demanding that they transfer funds in Arizona-based accounts for back payment. Those seizure orders threaten the banks that, if they do not transfer the funds, California will take the taxes and penalties owed from the banks instead. Not surprisingly, the banks almost uniformly consent to California’s strong-arm tactics.

Exhibit G in the filing provides an example where California demanded that Wells Fargo not only transfer the $800 tax, but also a $200 “demand penalty,” a $432 “late filing penalty,” a $79 “filing enforcement fee,” and $63.40 in interest, for a “Total Tax, Penalties, Interest and Fees” of $1574.40.

The lawsuit alleges that these seizure orders violate both the Due Process Clause (by exercising jurisdiction over out-of-state funds without the requisite “minimum contacts”); and, the Fourth Amendment (by effectuating seizures without a warrant, probable cause, or involvement of any court). Those seizure orders further preclude the banks from filing any court challenge.

Arizona’s suit seeks to end California’s unconstitutional tax encroachments.

Arizona LLC attorneys Richard Keyt and his son former CPA Richard C. Keyt give purchasers of their Silver and Gold LLC packages a subscription to their unique Arizona LLC Compliance Alert system. The Arizona LLC Compliance Alert System is a collection of email messages we send to all members of Silver and Gold LLCs we form.

The purpose of our Arizona LLC Compliance Alert System is to make sure the owners of LLCs we form know about important post formation tasks they need to accomplish.

Arizona LLC Email Alert System Table of Contents

The following is the subject list of the email alerts in our LLC Compliance Alert System that we send to people who purchase our Silver & Gold LLC packages. No other person who forms Arizona LLCs gives the LLC owners as much information as we give.

Below is a list of 40 tax savings actions you can use in 2019 to save federal income taxes. Some actions may require that you consult with an experienced tax accountant or tax advisor. To read detailed descriptions of these tax savings ideas you must subscribe to my free LLC newsletter by entering your information in my LLC newsletter subscription form.

[bctt tweet=”Learn 40 federal income tax savings actions you can use in 2019 to reduce your federal income taxes.” username=”azattorney”]

Table of Contents

Chapter 1: Bracket Management Strategies

#1: Bracket Management

#2: Capital Gain Harvesting

#3: Harvesting Capital Losses

#4: Trusts as S Corporation Shareholders: ESBT vs. QSST

Chapter 2: Income Smoothing Strategies

#5: Substantial Sale Charitable Remainder Trust (CRT)

#6: Retirement Charitable Remainder Trust

#7: Roth IRA Conversions

#8: Oil and Gas Investments

#9: Two-Year Installment Sale Strategy

#10: Nonqualified Tax Deferred Annuities

#11: Borrowing from Permanent Life Insurance Policies

Chapter 3: Income Shifting Strategies

#12: Income Shifting Charitable Remainder Trust

#13: Family Limited Partnership (FLP)

Chapter 4: Reducing Taxable Income Strategies

#14: Tax-Aware Investing

#15: Incomplete Gift, Non-Grantor (ING) Trusts

#16: Captive Insurance Companies

Chapter 5: Specific Net Investment Income Tax Strategies

#17: Inter Vivos Charitable Lead Annuity Trust (CLAT)

#18: Grouping Business Activities to Create Material Participation and Avoid the NIIT

#19: Choice of Filing Status to Avoid the 3.8% NIIT

Chapter 6: Wealth Transfer Strategies

#20: Intra-Family Loans

#21: Grantor Retained Annuity Trust (GRAT)

#22: Dynasty Trust

#23: IDGT Sale

#24: Domestic Asset Protection Trust (DAPT)

#25: Spousal Limited Access Trusts

Chapter 7: IRC Section 199A Planning

#26: IRC § 199A Overview

#27: Managing IRC § 199A Limitation Amounts

#28: Choice of Entity Decision After the TCJA–Converting a Pass-Through Entity to a C Corporation

#29: Using Multiple Trusts to Enhance the Benefits of IRC § 199A

#30: Aggregating Trades or Businesses to Increase the § 199A Deduction

Chapter 8: Ten More Must Know Strategies for 2019

#31: Trust Decanting

#32: S-Election to Save Employment Taxes

#34: Trusts Named as IRA Beneficiaries

#35: Sale to an Intentionally Defective Grantor Trust (IDGT) with a Self-Cancelling Installment Note (SCIN) Hedge

#36: Qualified Small Business Stock

#37: Opportunity Zones

#38: Puerto Rico Tax Incentives

#39: Timing the NQSO Exercise Decision

#40: Cost Segregation

If you are a non-U.S. citizen who is the sole member/owner of a U.S. limited liability company treated by the IRS as a disregarded entity (a “DE”) you must file an IRS form 5472 with the IRS on or before the due date of the Form 5472 or become liable to pay the IRS a penalty of $25,000. If you must file Form 5472 and fail to file it before the due date and then fail to file the Form 5472 within 90 days after the due date you will become liable for an additional $25,000 penalty.

The U.S. DE LLC must file Form 5472 if it had a reportable transaction with a foreign or domestic related party. To learn what are reportable transactions, who are related parties and more about this topic read my article called “LLCs 100% Owned by Foreign Persons Must File IRS Form 5472 or be Liable for $25,000 Penalty.”

[bctt tweet=”Learn about the $25,000 penalty when a foreign person who owns a U.S. LLC that is a disregarded entity fails to file IRS form 5472.” username=”azattorney”]

Complete the form below to get a free subscription to Arizona LLC attorney Richard Keyt’s weekly LLC email newsletter. We don’t share your information and you can cancel at any time by clicking on the unsubscribe link at the bottom of each email newsletter. After you submit your data we will send you an email message that asks you to confirm your email address unless you previously opted in to our system. If you don’t see our confirmation email in your inbox check your spam folder.

The Arizona Corporation Commission’s LLC services are much better than after it adopted its new software system on May 20, 2018. See “Arizona Corporation Commission’s New Database System Sucks.” The ACC continues to make far too many errors when it reviews Articles of Organization and other LLC filings, but it is making fewer errors than in the past. The time to review new expedited filings has decreased significantly.

Last July the ACC was reviewing expedited filings in 15 -20 business days and non-expedited filings in 54 – 59 business days. The current review times are 9 – 11 business days for expedited filings of new LLCs and 20 – 22 business days for non-expedited filings. See current processing times.

When people purchase my Silver or Gold LLC package one of the features they get is access to the 170+ page ebook I wrote called the “Arizona LLC Operations Manual.” In forming 9,500+ Arizona LLCs I learned a long time ago that people have the same post formation questions. I realized I could save myself a lot of time on the phone and answering emails if I wrote a book that answers all of people’s post LLC formation questions. See the Table of Contents to see the many LLC topics that are explained in the Operations Manual.

Here are four recent emails I got from happy LLC clients who wrote about the Operations Manual:

“The operations manual well written and easy to follow. A great tool to have as a guide and reference. I would recommend an LLC keep this guide for its existence. On a separate note thanks for the regular communication … wish all law firms were as easy to work with.”

“The LLC Operations Manual has been a great resource. Its is well organized and provides clear instructions on what tod (and what not to do).”

“The online book is very helpful, as well as the email alerts. I appreciate having the information that, for most the part, is easy to understand.”

“So, far I have not ended up with questions not covered by the book.”

Last month I attended a four hour seminar on Buy Sell Agreements. I’ve been drafting Buy Sell Agreements for LLCs since 1992, but the seminar gave me a lot of new information. I especially enjoyed the presentations by two very experienced business appraisers. The seminar caused me to review and revise my Buy Sell Agreement and to write several new articles about Buy Sell Agreements to help people learn about and understand why all multi-member LLCs (other than a married couple LLC) should have a comprehensive Buy Sell Agreement.

I also revised my online Buy Sell Agreement questionnaire to give my clients a lot of new options to select for their very custom drafted agreement. Scroll through my Buy Sell Agreement questionnaire and you will be amazed at the number of options and their depth. I doubt you could find anybody else that will give you as many options with respect to provisions to include or exclude from your Buy Sell Agreement.

Here is the list my articles about Buy Sell Agreements and why your multi-member LLC needs one drafted by somebody that knows what he or she is doing.

To learn more about Buy Sell Agreements and why your LLC needs one or needs to update its existing agreement sign up for my article called “Why Members of a Multi-Member LLC are Crazy if They Don’t Sign a Buy Sell Agreement.” To get this free article click on the link then give us your contact info and opt in. You will get the article and several follow up email messages that have more information about Buy Sell Agreements and how it can save you money and stress if the members of your LLC ever need to go their separate ways.

If you have any questions about Buy Sell Agreements call me at 480-664-7478 or my son Arizona LLC attorney and former CPA Richard C. Keyt at 480-664-7472. We don’t charge to answer questions over the phone.

Because the Arizona Corporation Commission’s new database is broken and apparently can’t be fixed the time the ACC takes to review and approve the Articles of Organization filed to create a new Arizona LLC or PLLC has sky-rocketed through the roof. To see how long it will take for the Arizona Corporation Commission to review and approve your company’s Articles of Organization go to the ACC’s processing times web page. See also my article called “Arizona Corporation Commission’s New Database System Sucks.”

This delay is preventing people from opening a bank account in the name of the newly formed company. Most of the large national banks and some smaller banks in Arizona will not open a bank account for a newly formed LLC or PLLC until after the Arizona Corporation Commission approves the company’s Articles of Organization. If you cannot wait until the ACC approves the Articles of Organization of your newly formed Arizona LLC or PLLC you can open a bank account before the Articles are approved if you go to one of the banks listed below.

We got the following message in an email we received from the Arizona Corporation Commission today, October 1, 2018:

“THE DOCUMENT INTAKE MAILBOX IS BEING DISCONTINUED, EFFECTIVE AT 5:00 P.M. MST, OCTOBER 5, 2018. We will continue to accept documents emailed to [email protected] through October 5, 2018 at 5 pm MST. After that point, the mailbox will be closed and will not accept any additional emails. We strongly encourage you to use online filing available at http://ecorp.azcc.gov. We will continue to accept paper documents mailed or walked in to 1300 W. Washington St, Phoenix, AZ 85007. If you have any questions, please call Customer Service at 602-542-3026.”

This is very troubling. We have sent problems that needed fixing for LLCs and corporations to this email address for a very long time. Now instead of continuing a reliable method of communication the Arizona Corporation Commission wants people to use its broken online ecorp system.

Question: How can I get a Certificate of Good standing for my Arizona LLC from the Arizona Corporation Commission?

Answer: The first thing you need to know is you should not follow the instructions on the Arizona Corporation Commission’s website because those instructions are wrong. Second, the process is complicated, which is why I created an instructional video that shows you what you must do to purchase the COGS for $45 and immediately download a Certificate of Good Standing.

Watch my video below called “How to Get a Certificate of Good Standing from the ACC” then you will be able to get the COGS in 5 – 10 minutes using the Arizona Corporation Commission’s online ecorp system.

Last month I wrote a blog post called “Arizona Corporation Commission’s New Database System Sucks.” The article alerts the public to some of the many problems created by the ACC switching to a new software system on May 20, 2018. Here is the Arizona Corporation Commission’s response to my blog post:

“Commissioner Olson forwarded your e-mail to me and asked me to investigate the progress that the Corporations Division has made so far on their new database system. Here are some of the updates:

1. They are familiar with Rick Keyt’s complaints which have mostly been resolved, but they will be following up. Some of the customers who made filings during the first 3 months of rolling out the new program still have some minor issues which are being resolved.

2. They do have a system in place to accommodate urgent requests from customers who reach out to the Commission Offices, so as soon as Commissioner Olson’s office hears about a specific issue, we inform the Corporations Division and they are able to resolve the issues pretty quickly on an individual basis.

3. Overall, the early issues they experienced with the new system during the first two months are much, much better. The little things, like the search date/time that Mr. Keyt pointed out, are resolved. The bigger things, like dates, have seen substantial improvements, but they are still working out a few bugs. They just entered the warranty phase of the contract with the vendor, and the remaining bugs should be fixed over the next 90 days, per the contract.

4. Unfortunately, they are still struggling with processing times right now. Some of that was due to a back-log that built up during the initial phase of the transition, but they have now gotten through all the documents that migrated from the old system, and are now examining documents filed during the first 2 months in the new system. These documents require a lot of corrections, and that takes time. The Corporations Division is working with the Executive Director, Matt Neubert, on potential solutions to improve the processing times, since it usually boils down to additional resources.

That is the update so far, we are hopeful that more information and progress will be forthcoming and we will continue to update the interested parties as we are given new information.

Thank-you for reaching out to Commissioner Olson, we are keeping a close eye on this issue. Also thank-you for the article you shared, if you know of anyone else having similar issues, please send them our way!

Thank-you,

Jacqueline Parker, Esq.

Deputy Policy Advisor to Commissioner Olson

Arizona Corporation Commission

1200 W. Washington Street

Phoenix, Arizona 85007

(602) 542-0745 (office)

(602) 542-4144 (direct line)

[email protected]

www.azcc.gov

We have noticed that the ACC is making fewer errors. Hopefully it will be able to work out all of the kinks and get the new software system working smoothly.

Most multi-member LLCs other than a two member LLC owned by a married couple should have an exit strategy because like marriages, more than fifty percent of multi-member LLCs have one or more members who want a company divorce. If members of a multi-member company do not sign a contract that provides for the buy out of one or more members on the happening of an event described in the contract they are stuck together forever unless a member convinces a court in an expensive lawsuit to judicially dissolve the company. See my article on this important topic called “A Multi-Member LLC’s Most Important Document” aka a “Buy Sell Agreement.”

My Buy Sell Agreement is very comprehensive because it is the product of my 38 years of being a business lawyer who has seen far too many LLC divorces. I updated my Buy Sell Agreement to add more “triggering events.” A triggering event is an event that gives the company an option to buy the entire membership interest of the member who is involved in the event. Members can also provide in their Buy Sell Agreement that certain triggering events such as the death of a member require the company to buy the entire membership interest from the estate of a deceased member.

To hire me to prepare a Buy Sell Agreement one of the members must complete and submit my online Buy Sell Agreement questionnaire. The questionnaire asks the LLC member who completes the questionnaire to pick and chose the provisions and triggering events that will be included in their company’s Buy Sell Agreement. Look at the Buy Sell Agreement questionnaire to see the many triggering events that you can select or deselect for your company’s custom drafted Buy Sell Agreement. FYI: We can also arrange for all members to digitally sign their Buy Sell Agreement using DocuSign.

Here is a list of the triggering events from which my clients can select for their Buy Sell Agreement.

| 1. Any event the members desire | A Buy Sell Agreement can include any triggering events that are important to the members. For example, the members could agree that if the New York Yankees win the World Series, member 1 must sell to member 2 for $100. |

| 2. Operating Agreement default | If a member defaults under the Operating Agreement signed by all of the members the LLC has an option to buy out the defaulting member. |

| 3. Member fails to contribute money or property | This provision encourages a member to satisfy the member's obligation in a written document to pay money or assign property to the company because if the member fails to satisfy that obligation the LLC will have an option to buy out the defaulting member. |

| 4. Death of a member | The LLC or surviving members have an option to purchase the interest of a deceased member. The Buy Sell Agreement can also require the LLC to buy-out a deceased member. These types of buy outs can be funded with life insure on the lives of members. |

| 5. Member is convicted of a felony | Many LLC members do not want to have another member who has been convicted of a felony. |

| 6. Divorce of a member | Prevents the wrong spouse from acquiring an interest in the LLC if two members own their interest as community property and they get divorced and the wrong spouse becomes the sole owner of all or a portion of the membership interest. |

| 7. Member files for bankruptcy | If a member loses the member's interest in the LLC because of filing for bankruptcy, the company and other members should be able to buy the interest from the creditor who acquires it out of the bankruptcy. |

| 8. Member transfers all or part of the member's membership interest without the approval of the other members | The Buy Sell Agreement provides that a member may not transfer or encumber all or any interest in the member's interest in the company without the approval of the members and compliance with the terms and conditions of the Operating Agreement and/or the Buy Sell Agreement. If a member violates the no transfer/encumbrance provisions, the LLC should have an option to acquire the interest of the defaulting member, perhaps at an amount less than the fair market value of the interest. |

| 9. Termination of employment of a member | Applies only to a member who is employed full time by the LLC. Especially important when the employee is a minority member and should only own an interest while employed. |

| 10. Member loses his or her professional license | Commonly used for LLC's that are owned by members who must be licensed in a particular area. For example, the Buy Sell Agreement of an LLC owned by physicians might give the LLC and other members an option to acquire the interest of a physician/member who loses his or her license to practice medicine. |

| 11. Majority member sells membership interest | "Drag Along" provision: Majority member has the option to require minority members to sell their interests in the LLC if the majority member sells. The sale of the minority members' interests are on the same terms and conditions as the sale of the majority member's interest. |

| 12. Majority member sells membership interest | "Tag Along" provision: Minority members have the option to require the majority member to include the sale of the minority members' interests in the LLC if the majority member intends to sell. The sale of the minority members' interests must be on the same terms and conditions as the sale of the majority member's interest. |

| 13. Member is disabled | Used to acquire the interest of a member who become permanently disabled and unable to provide needed services for the LLC. |

| 14. Member retires | Members sometimes want to retire, but without a Buy Sell Agreement that provides for a retirement purchase, it probably will not happen. |

| 15. Member is incompetent | Applies if a member loses his or her mental capacity and a court appoints a conservator to manage the members financial affair. |

| 16. Member files a false document with the ACC | If a member causes a false document to be filed with the Arizona Corporation Commission it is a triggering event that can cause a buy out, |

| 17. Member causes somebody to be added or removed from the LLC's bank account | If a member causes a signer to be added or removed on the company's bank account without the approval of the members per the operating agreement it is a triggering event that can cause a buy out. |

My Buy Sell Agreement also contains the following provisions:

Questions?

If you have any questions about Buy Sell Agreements, call me, Richard Keyt, at 480-884-7478 or send an email message to me at [email protected]. I don’t charge to answer questions about Buy Sell Agreements.

How to Purchase an LLC Buy Sell Agreement

To hire me to prepare your Buy Sell Agreement complete and submit my Buy Sell Agreement questionnaire.