Arizona Corporation Commission’s New Database System Sucks

This article explains a very serious problem that affects most Arizona LLCs and PLLCs that have filed paper (not online filed) Articles of Organization or amendments to Articles of Organization after May 19, 2018. If you have a company that filed paper articles or amended articles with the Arizona Corporation Commission after that date you need to read this article so you will understand the problems the ACC probably created for you and your company.

ACC Adopts New Software System that Is Crap

On May 20, 2018, the Arizona Corporation Commission stopped using the database and related software that served the public well for many years and switched to a new database system that is broken and may not be fixable. Before the new software went live the ACC was reviewing expedited filings in 3 – 5 business days and non-expedited filings in 20 – 25 business days. According to the ACC’s processing time report dated July 30, 2018, the new and improved software system enables the ACC to review expedited filings in 15 -20 business days and non-expedited filings in 54 – 59 business days.

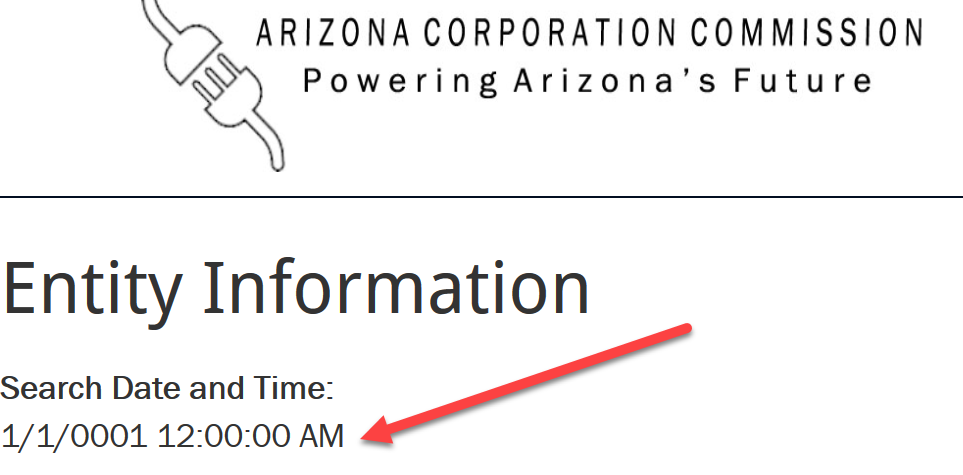

Here’s an example of the broken software system. I did a search for an Arizona LLC. Note the date and time of the search, which was 1/1/0001. My search did not occur in the year after Jesus was born. How is it possible the software programmers were unable to program the software to display the date and time of a search? Very troubling.

The Biggest Problem is the ACC Cannot Put Correct Information on Approved Filings

The new software system prevents the Arizona Corporation Commission from compiling and disseminating accurate and correct information. Between May 24, 2018, and July 13, 2018, we filed Articles of Organization for SIXTY-FIVE LLCs that the ACC has approved, but whose approval documents contain ACC created errors that the ACC is unable to fix. Despite our many requests to fix incorrect dates and text the ACC put on approved documents the ACC has been unable to correct a single item of bad information it stamped on the companies’ approval documents. Update 8/14/18: On this date we got the first entirely correct approved Articles of Organization, ACC approval letter and ACC website information of the 110 Articles we filed after May 20, 2018.

When the ACC approves new Articles of Organization there are three ACC created sources of information about the new company. Information about the new company is found in the following locations:

- the top of the first page of the filed Articles of Organization returned to the company

- the ACC’s approval letter given to the company

- the ACC’s website

Not one of the 65 companies we formed between May 20, 2018, and July 13, 2018, that have been approved by the ACC has the correct filing date and correct information on all three of the above sources. Despite repeated requests given to ACC personnel asking them to correct the ACC errors it has not corrected a single company’s incorrect data.

Illustrations of ACC Created Problems

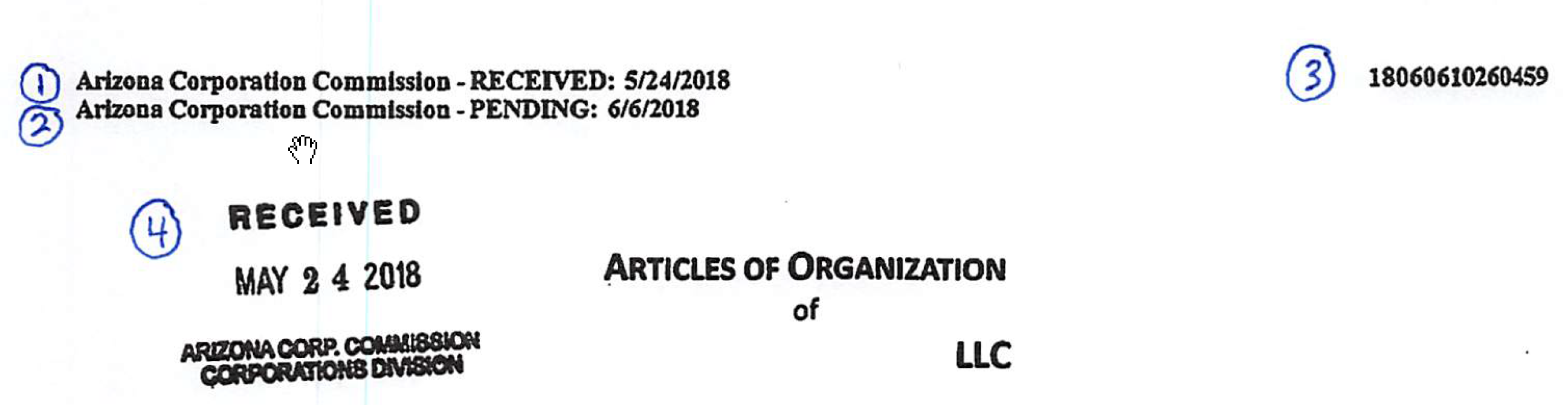

The images below contain numbers in circles that refer to areas of Articles and approval letters and the website that have un-fixable errors. The numbers in circles will be explained below.

Top of the Filed Articles of Organization

Articles of Organization Problems

The information next to numbers in a circle above is imprinted on the Articles of Organization by the ACC and then given to the company after it approves the filing of the Articles of Organization or amendment to the Articles of Organization. The significance of each type of information shown above that has a number in a circle:

Circle 1: The “received” date. This is supposed to be the date the ACC received the Articles of Organization or the amendment. This line may or may not be the actual date the ACC received the document.

Circle 2: The “pending” or “filed” date. Some times this line says “pending” followed by a date. Some times it says “filed” followed by a date. The filed date should always be the date the ACC received the Articles of Organization or the amendment. Note: If the ACC approved the document this line should say “filed” (not “pending”) followed by the date the ACC received the Articles of Organization or the amendment. This line may or may not be the actual date the ACC received the document, which date is the actual date the document was filed.

Circle 3: I don’t have a clue what this long number is, but the ACC stamps it on the top right of each page of the approved document.

Circle 4: The approved document may or may not have this stamp under the first two lines the ACC puts on the top left of the first page. In the good old days when the ACC was doing its job it always stamped its “Filed” stamp on the top of the first page of the document. The stamp include the ACC’s file number given to the company. Now the ACC never stamps its “Filed” stamp or the company’s file number on the approved document. Sometimes the document may display the “Received” stamp, which is a good thing because the Received stamp always displays the correct date the document was received and filed.

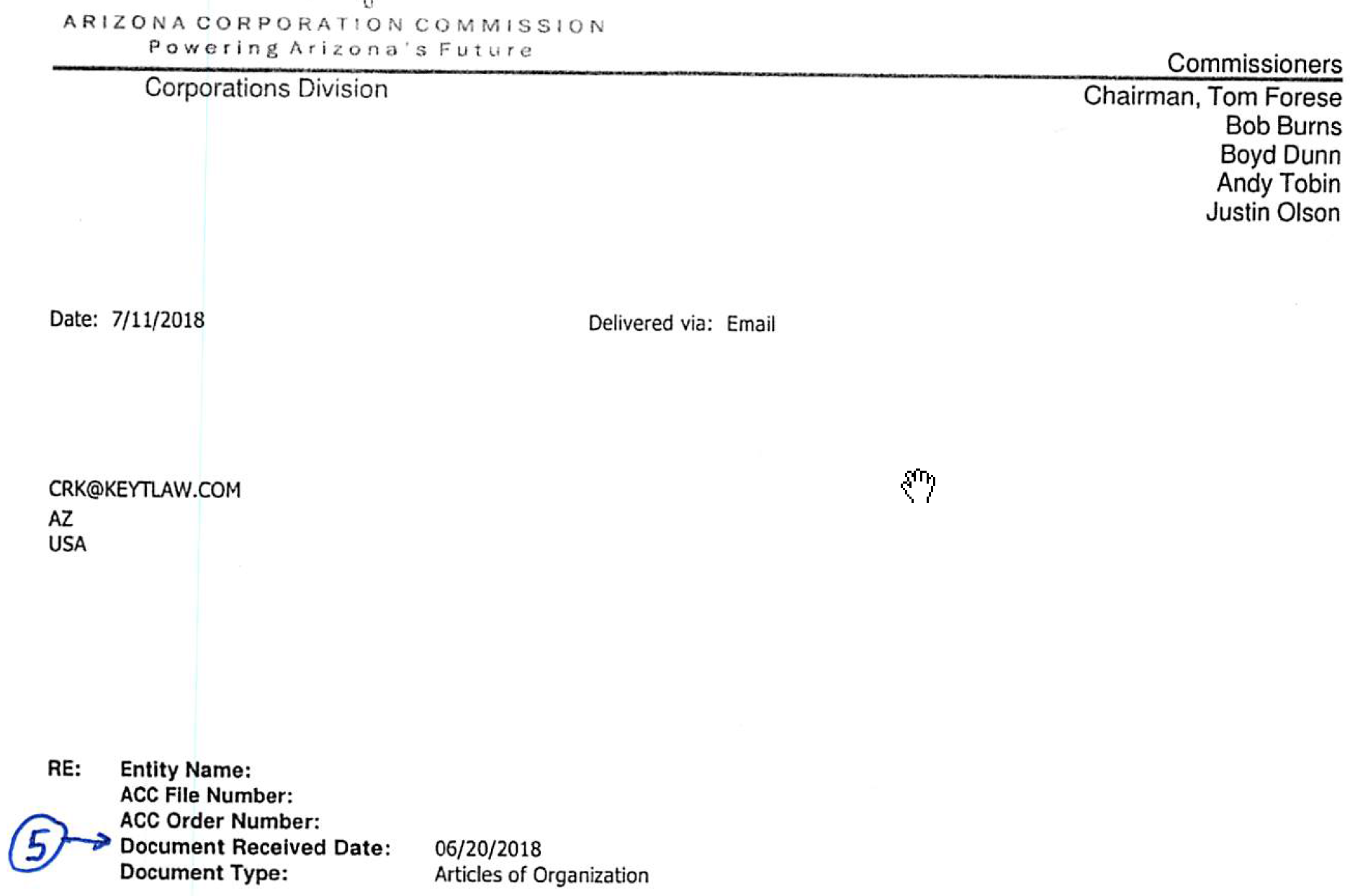

ACC Approval Letter Problem

Circle 5: This image is the top of the ACC’s letter given to companies when it approves the filed Articles or Organization or amendment to the Articles of Organization. The document received date should be the date the ACC received the document. This date may not be the actual date the ACC received the document.

ACC’s Company Web Page

Circle 6: The formation date should be the date the ACC received the Articles of Organization or the amendment to the Articles of Organization. This date is frequently wrong.

Circle 7: The Original Incorporation Date is the Formation Date. These two dates should be the same and should be the date the ACC received the Articles of Organization or the amendment to the Articles of Organization. This date is frequently wrong.

Circle 8: The Entity Status should say “Active,” which means the company exists.

Circle 9: The Reason for Status should say “In Good Standing.”

Important Note: If a third party asks for proof that your company exists show the ACC’s web page for the company and point out that the Entity Status is “Active” and the company is “In Good Standing.”

Bottom Line

When your company’s paper filed (not filed online) Articles of Organization have been approved by the ACC the date the ACC received the document should be the same as the filed date. The received/filed date should be the same on each of the following locations:

- Circle 1

- Circle 2: This should say filed, not pending.

- Circle 4: If this stamp is on your document it should show the date the document was received by the ACC

- Circle 5

- Circle 6

- Circle 7

If your approved Articles of Organization, ACC approval letter or ACC website listing contain errors and you want to fix the errors call the Arizona Corporation Commission at 602-542-3026.