Scottsdale Estate Plan Attorneys' Estate Plan Contents

by Arizona estate planning attorneys Richard Keyt (Rick, the father) and Richard C. Keyt (Ricky, the son)

Benefits of a Trust & Estate Plan

See our article called “15 Benefits of Having an Estate Plan with a Revocable Living Trust.”

We are Scottsdale estate planning attorneys with over 50 years of combined estate planning experience who have prepared 650+ estate plans. We want to have a free meeting with you to answer your questions and design a comprehensive estate plan that protects your most valuable assets – your loved ones.

Sixty-seven percent of Americans do not have an estate plan. Don't be one of them. If you don't have a will or a trust, the intestate succession law of your state of residence, not you, will determine who inherits your assets when you die. For Arizona residents:

- Take our short online quiz called Who Inherits Your Property to learn who Arizona will give your assets to if you die without a will or a trust.

Book a Free Meeting to Get Answers to Your Questions & Design Your Estate Plan that Gives You Peace of Mind and Protects Your Loved Ones

The first step to protect your loved ones and ensure your assets go to your desired heir(s) is to book a free office, phone, or Zoom video consultation with one of the Keyts. During this no-obligation meeting, they will answer your questions and design your estate plan.

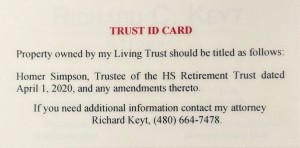

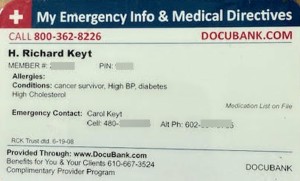

Call Rick at 480-664-7478 or Ricky at 480-664-7472. See Rick's virtual business card.

Our 266 Google Reviews

KEYTLAW did an excellent job of creating our LLC. I was needing some adjustments to the documentation and they were more than willing to make changes without any fuss! We also created an LLC with a trust and while at the bank we needed help answering a question concerning this, my husband picked up the phone and was instantly given the answer needed. They are knowledgeable, friendly, and super helpful!

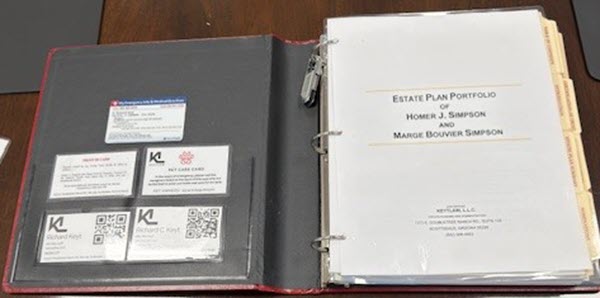

The book that they put together was beyond helpful! I took it to the bank and answered questions using it for a new account. Thank you KEYT LAW for your professionalism!

Working with Keyt Law has been an exceptional experience from start to finish. I actually discovered them through ChatGPT after asking for the top LLC & Trust attorney in Arizona—and they truly lived up to the recommendation. Their reviews speak for themselves, and I found their team to be knowledgeable, responsive, and incredibly easy to work with. They made the entire process clear and straightforward. I’ll absolutely be referring all my friends and family to Keyt Law!

WOW what a class act and a true professional that you would be lucky to have represent you with their impeccable reputation!

Mr. Keyt has helped me on two occasions beyond what I thought an attorney would ever do to help a street kid get to the next level!

His son is remarkable plus he is a CPA and they have helped far better protect my assets while helping me to decrease my tax liabilities.

I couldn’t be happier with my new home in AZ due to the incredible people and the beautiful weather, just the best state in US!

I sleep well knowing the Keyts will be my representation for the rest of my days right here in my beloved home in AZ!!

Thank you both I appreciate you more than I can articulate here to do it justice…

Mike

Absolutely wonderful people to work with. They created my trust documents quickly and were very professional. I was referred by a friend and have been referring Keyt Law to my friends as well. Affordable, professional, friendly, knowledgeable and extremely helpful. I would highly suggest calling them for your estate planning needs.

KEYTLaw helped me form my LLC and they were fast and it was painless. They formed the LLC the same day I initially called them.

Richard Keyt has created 2 LLC's for me over the past 10 years and is the Statutory Agent for both of my LLC's. He is easy to get ahold of. His systems are streamlined and simple. And he keeps me abreast of any new laws that affect me. I trust Richard implicitly and would refer him to anyone who is starting a business, wants an attorney to set up their LLC correctly, and ensure that they stay in compliance moving forward.

We've used Keyt Law for many things and they are always at the top of their game!

They set up an LLC for me. It was painless and all done electronically. Happy Camper!

I recently had the pleasure of working with Richard Keyt to create two LLCs, and I cannot recommend his services enough. From start to finish, Richard demonstrated an exceptional level of professionalism, responsiveness, and expertise that made the entire process seamless and stress-free.

What truly stood out was his ability to address all of my questions and concerns promptly and clearly. No matter how detailed or complex my inquiries were, Richard took the time to provide thorough explanations, ensuring I felt confident every step of the way. His responsiveness was remarkable – I never had to wait long for answers or updates, which is a rare and highly appreciated quality.

The process of forming the LLCs was incredibly fast, yet nothing was rushed or overlooked. Richard’s attention to detail and his deep understanding of the legal intricacies made it clear that I was in the best hands.

If you are looking for someone who is knowledgeable, efficient, and genuinely dedicated to helping you achieve your goals, Richard Keyt is the person to call. Thank you for making this experience so smooth and for providing such outstanding service!

Highly recommended!

This law firm is so professional and they care and delivers a positive results for the clients...

Simply the best.

Keyt is great. I know several folks who have used them and found my own experience to be clear, comprehensive, and well-priced.

Keyt Law is lights out one of the best options to form and manage legal entities. Richard helped us get an LLC off the ground in literally hours and let us secure a great investment. Very easy process and very informative. LLC's, estate planning, and just good advice. If you are considering forming any legal entity, Richards Services are a no brainer. We have used him several times and keep coming back.... And he answers his phone!!

KEYTLaw made setting up an LLC as easy as possible with a well documented step by step process. Highly recommended.

Keyt Law has set up many LLC's for me over the years. They always provide efficient and quality service.

I found KEYT law via a web search and later was also referred by a trusted friend who has used their services a few times. I can't say enough good about them. The process of creating an LLC and trust was painless, straightforward, and affordable. Richard explained things to me in non-legal terms that I could understand during my free consultation, and within 24 hrs both the LLC and trust were set up. Communication is fantastic, and their experience speaks for itself. I am deeply grateful I was guided to them, and will continue to recommend their excellent services!

Keyt Law was professional, informative and very efficient. They made the process simple and thorough. We will use again and recommend to others. Thank you for your assistance in getting us started with our new company, we appreciate you!

These guys are great. I had multiple phone calls with them to answer questions. They set up my Trust and private LLC. I'm super happy. Thanks.

My contact with Keyt Law started with online scheduling of a meeting to discuss my needs for setting up my corporate entity. Ricky was very knowledgeable and knew which questions to ask to determine my needs. It was a no non-sense experience and very little time was wasted. There was no pressure or upselling, just a discussion about what Keyt Law offers and which product suited my needs. I’ve started various corporate entities and trusts in the past. The questionnaire that is sent to be filled out was extensive, detailed and exhaustive. The experience was excellent.

Keyt Law seems to have setup a process which takes a systematic approach to formation of various legal entities. When I see this, I feel more comfortable with the process given the detail and context in the process described above. “They know what they are doing.”

Given the costs of doing business these days, I can say that I’ve found quite a bit of value in the follow-up emails. They are educational in nature and have guided me through an increasingly complicated process of forming corporate entities. They range from IRS tax election of corporate entities to FinCEN management and corporate lease/real estate issues to survivorship and succession.

You get hard copies of all of the documents and relevant materials mailed to you when the process is far enough along, and documents are presented in a high quality and professional manner.

Overall, I’d say there is a lot of value to be had here. I think Ricky is quite capable and I’m guessing the apple didn’t fall far from the tree - I’ll bet his father is just as sharp.

Will definitely be a repeat customer when the time comes. Thank you, Ricky, for what you do.

Very responsive from the first phone call to the actual formation of my LLC. I was impressed by all of the free information available on the KEYTLaw website and they are just as helpful by phone. I got overwhelmed by the nuances of knowing what to do to form my LLC on my own but I am glad I found KEYTLaw. They did in a few hours what was taking me over a week to do. The daily alerts are really helpful as well because there are "after formation" tasks that need to be completed, so I appreciated the reminders.

Richard and his staff at KeyLaw, LLC were great to deal with in setting up our LLC. Their responses to our questions and concerns were addressed quickly and the entire process was extremely smooth...a very good team!

They are the best law firm for my LLC

THANK YOU KEYT

The best services ever all the way from the assistance team to Mr Keyt.thank you for helping us navigate to our complex legal system

Richard and his staff have been so helpful in setting up an LLC. Quick to respond and very knowledgeable. Thank you!

We got it setup nice. Thank you very much.

Keytlaw and Richard, Ricky, Amanda, Michelle and their entire team ->highly responsive, experienced and useful in setting up proper registrations and LLCs in Arizona. Highly recommend over other online/digital alternatives, and was able to speak to them within minutes! Thanks Keytlaw!

Thank you Richard and Amanda for helping us in forming real estate LLC property and filing Special Warranty Deed with county.

I encourage all to use Keyt Law for their legal expertise in creating Trust and will, LLC, warranty deeds etc

Seemingly too good to be true but KEYTLaw delivers as advertised - exceptional service and highly recommended. I can't imagine a more simple, efficient, and professional way to set up an LLC in full compliance. I was up and running in a day, got live phone support on my questions, and have continued to get benefit from all the guidance and content available to those who engage Keyt for this service. Fanatastic.

Fabulous!!! Knowledgeable, fast and easy to work with!

I want to thank the Keyt Law team for all their help over the years. They do a great job and I appreciate their customer service. THANK YOU

Talk about service! I was unable to located my LLC "Operating Agreement" that Keytlaw formed in 2007. Called Rick and literally within a minute Rick was emailing me the agreement. Thank you Rick, y'all are the best!!

I was highly impressed by all aspects of Keyt Law in forming my LLC. Professional, very timely, and an overall excellent experience!! I will certainly do more business with them in the future. Highly recommend!!

The process was quick and easy. What I don't like are emails being sent in which they are not applicable to my company and are not required or needed.

KEYTLaw is truly outstanding, and exceeded our expectations with their stellar estate planning expertise and impeccable LLC services. We're immensely grateful for their exceptional work, feeling assured that their prowess truly defines the pinnacle of legal excellence."

Very prompt and professional. I was even able to schedule a FREE 30 minute consultation prior to hiring them! Highly recommended!

Richard and his team are very experienced and knowledgeable in forming Trust and LLCs. They helped us to come up with an LLC structure that provides the protection we need for our investment properties. I was able to discuss with Richard and had all my questions answered within days of contacting the team. Besides the scheduled meetings, Richard also responded to calls and emails promptly to help us to make decisions quickly. I highly recommend Richard KeytLaw if you need help with LLCs, Trust, or any business formation.

Richard and his team is very experienced and knowledgeable in helping us to form LLCs. They helped us to come up with a LLC structure that provides the protection we need for our investment properties. We were able to discuss with Richard and had all our questions answered within days from contacting the team. Besides the scheduled meetings, Richard also responded emails promptly to help us to make decisions quickly. We really recommend Richard KeytLaw if you need help with LLCs.

My husband and I have been researching the LLC laws and law firms for asset protection for a while. We had discussions with a few online companies including a nationally well-known company before making decision to go with KeytLaw. Some of them recommended overly complex LLC structures with a huge setting cost and on-going maintenance fee. We eventually decided to go with KeytLaw because of Richard's experiences and knowledge about Arizona Law, their accessibility, and their fee structure. We are very happy with the decision to go with Richard and plan to use their service for estate planning in the future.

I would recommend KeytLaw for any legal services they need! They helped me form my LLC and it was very straightforward and quick I called and talked to both Richard and his son in regards to some questions that came up and they were very helpful. I will be returning for their help in the near future for my estate planning.

Richard is phenomenal. Top class service

Very informative, professional and thorough. Very satisfied with my services and 💯 recommend!

The team at KEYT Law was awesome in helping me set up my business. The paperwork processing was a breeze, and they answered all the questions we had, KEYT Law is the best in the business in Arizona for your business set up needs.

The Keyts make it so painless to take care of your estate planning needs. With one reasonable flat fee for a package of documents you are all set.

36 Documents & Services in Our Estate Plan

We doubt you will find an estate planning attorney whose estate plan includes as many documents and services as we provide. Look at other estate planning lawyers' websites, and they usually don't tell you what you get if you hire them or the fees they charge. We don't hide the ball. Our estate plan fees are shown at the end of the list of documents and services.

The toggles below describe the 36 documents and services you will get if you hire us to prepare your estate plan. To open a toggle click on a down arrow or the text to the right of a down arrow. Click the up arrow to close an open text box.

Stop Procrastinating: Protect Your Family Before It Is Too Late

Book a Free Estate Plan Consultation

If, like most people, you have procrastinated and do not have an estate plan that protects your loved ones, and you do not purchase our estate plan, the sad reality is that you will most likely continue to procrastinate for many years to come and probably will die without protecting your loved ones. That’s ok if you want the State of Arizona to decide who inherits your property and if you don’t care about the problems and expenses your family may suffer if you die without planning.

Isn’t your family your most valuable asset? Don’t you want your family to have the protection a good estate plan provides? If the cost is preventing you from making an appointment, compare the cost of an estate plan against the money you have spent on things for yourself, such as a flat-screen TV, furniture, swimming pool, computer system, hi-fi system, car or SUV, boat, country club membership, jewelry, art and other “toys” or expensive items. Don’t spend more on “stuff” than you would pay to protect your family if something happens to you.

Estate Plan Fee

Our fees for preparing the documents listed above and providing the other related services (no charge for phone calls, office meetings, emails or texts) are:

- $4,497 for a married couple

- $3,497 for a married couple who bought our Gold LLC within 120 days

- $2,497 for one person who bought our Gold LLC within 120 days

Optional Services & Fees

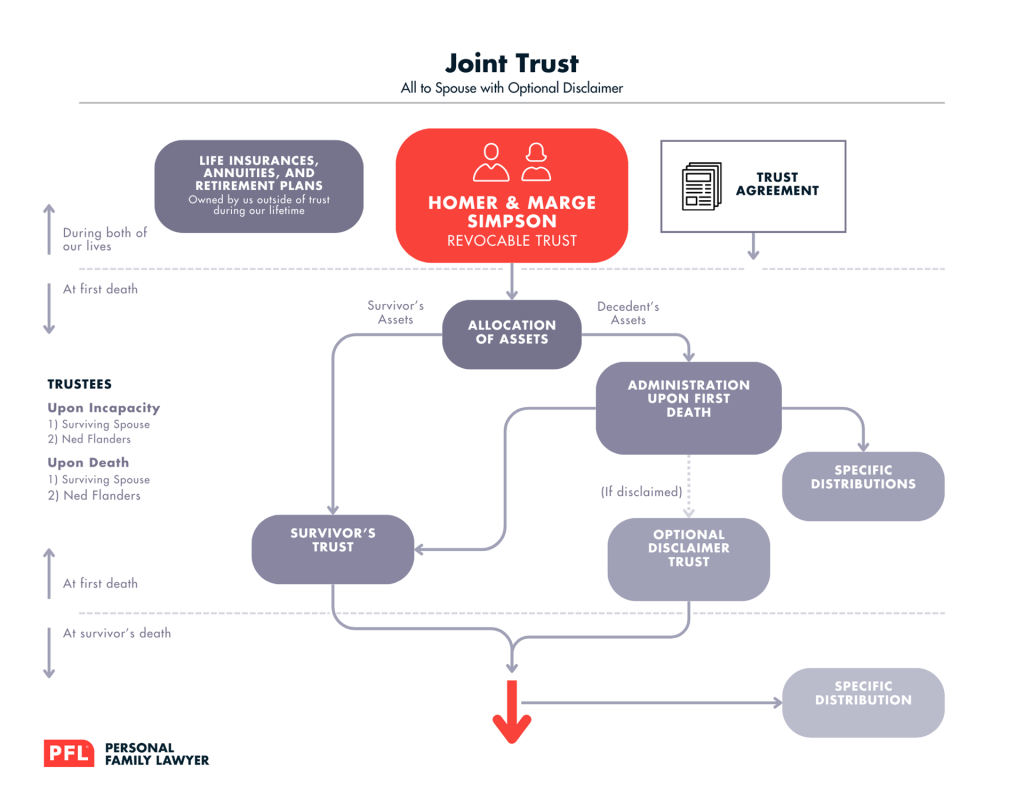

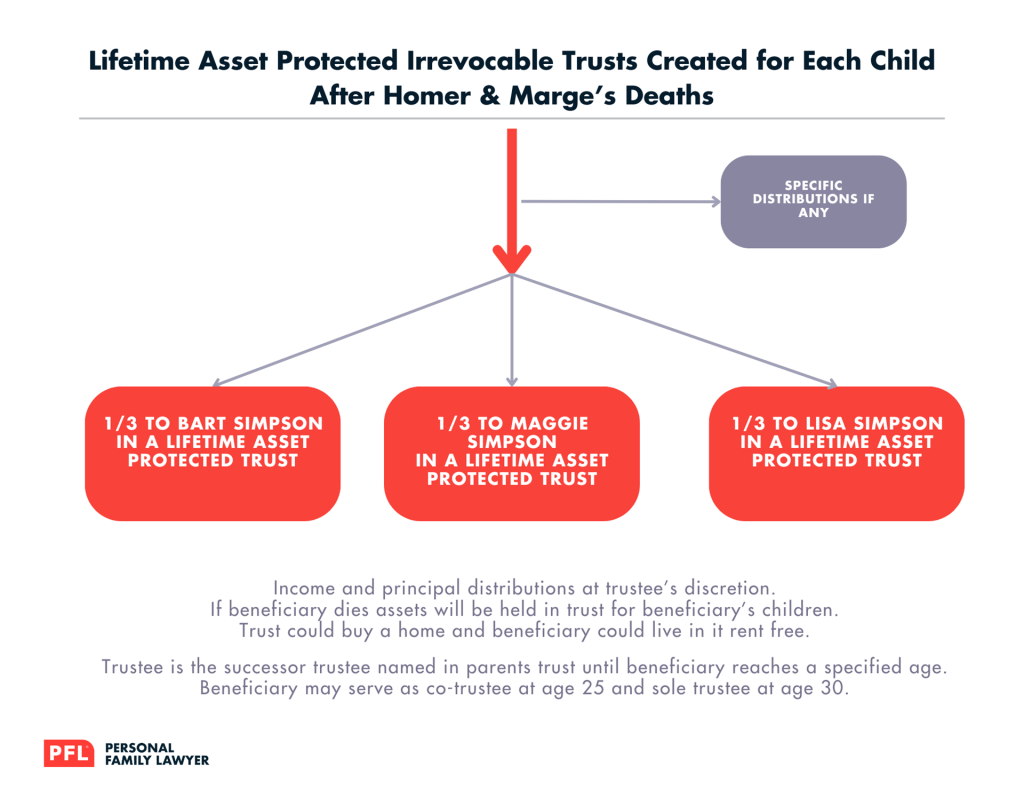

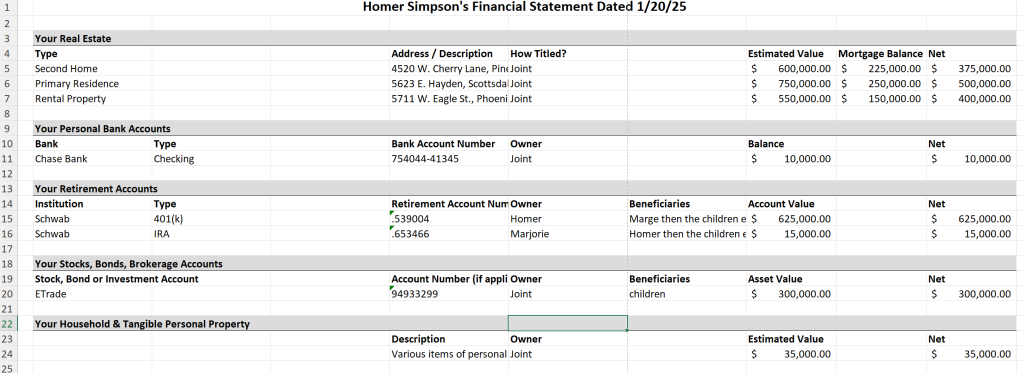

- $1,000 to add language to your trust agreement that will create an irrevocable asset-protected trust for each future beneficiary after your death or if you are married after the death of the second spouse. The irrevocable trust will protect each beneficiary's inheritance from creditors, ex-spouses and bankruptcy courts. If you don't buy this option, your trust will distribute each beneficiary's trust assets outright to the beneficiary without any asset protection at the age(s) you designate in your trust.

- $2,000 to hire our trust funding service to transfer your assets to your trust. This service includes transferring two LLCs and two Arizona real properties other than your home that we transfer as part of your estate plan.

How to Buy Our Estate Plan

Book a free office, phone or Zoom video consultation to answer your questions and plan and design your estate plan.